nc sales tax on restaurant food

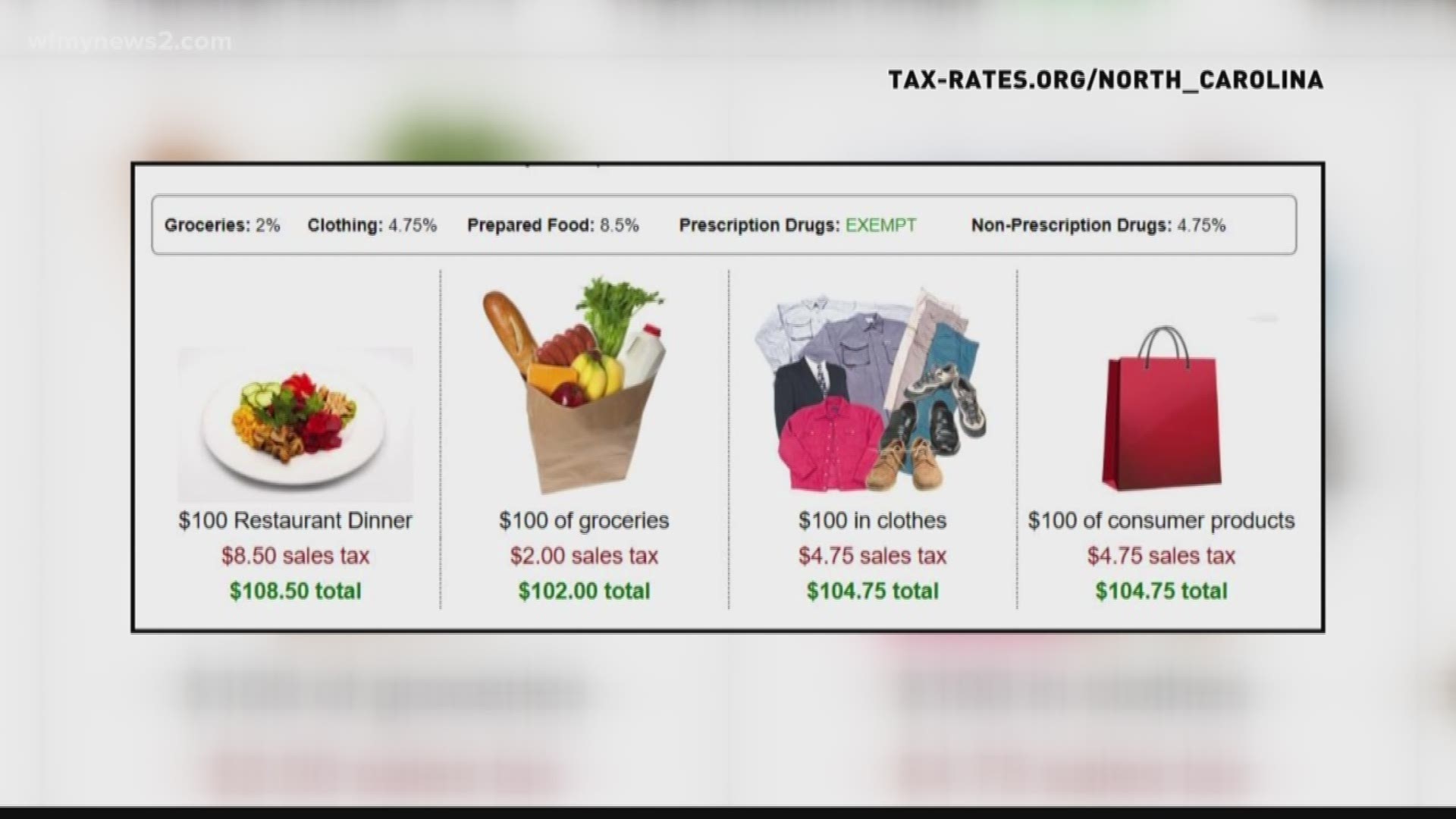

Goods sold by artisan bakeries without eating utensils are considered non-taxable at the state level though they are subject to the 2 local sales tax just like groceries. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales.

Are You Required To Pay Sales Tax On Restaurant Food Purchased For Resale

This tax chart is provided for the convenience of the retailer in computing the applicable sales and use tax of Food.

. As of 2014 there were 1012 taxing districts in North Carolina including counties cities and. Form E-502R 2 Food Sales and Use Tax Chart. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

North Carolina has a 475 statewide sales tax rate but also has 323 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2188 on top of the state tax. PO Box 25000 Raleigh NC 27640-0640. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule.

For more information call us at 214 516-6900 Outlet. North Carolina has recent rate changes Fri Jan 01 2021. These categories may have some further qualifications before the special rate applies such as a price cap on clothing items.

Sales and Use Tax Withholding Tax Corporate Income Franchise Tax. You can find more examples of when prepared food is and is not taxable in Section 32 of the latest North Carolina Sales and Use Tax Bulletin. The general State and applicable local and transit rates of sales and use tax apply to the sales price of each article of tangible personal property that is not subject to tax under another subdivision in NC.

Restaurants Bars and Other Similar Establishments. Restaurant meals are subject to sales tax in some states eg Connecticut whether served at the restaurant sold to go or delivered to the purchasers location. Counties and cities in North Carolina are allowed to charge an additional local sales tax on top of the North Carolina state sales tax.

The transit and other local rates do not apply to qualifying food. How can we make this page better for you. The state sales tax rate in North Carolina is 4750.

Woodburn Company Stores is the largest tax free outlet mall in the western part of the United States and the largest outlet in the state of Oregon. Select the North Carolina city from the list of popular cities below to. Blauvelt NY 10913 845 353-1800 If you are engaged as an alcoholic beverage distributor in New York you are required under Article 18 of the State of New York tax law to file a New York Alcoholic Beverage Distributor Bond as a condition of licensure.

This tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises by any retailer with sales in Wake County that are subject to sales tax imposed by the State under North. One percent 1 of the sales derived from prepared food and beverages sold is assessed at retail for consumption on or off the premises are assessed by any retailer within the County that is subject to sales tax imposed by the State of North Carolina. North Carolina defines prepared food as in part 1 food sold in a heated state or 2 food consisting of two or more foods mixed together by the retailer as a single item which does not require further cooking to prevent food borne illnesses or 3 food sold with eating utensils provided by the seller plates.

NCDOR Taxes Forms Sales and Use Tax. Lets start with sales tax. Walk-ins and appointment information.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. 35 rows Alexander.

Listing Results 1 - 24 of 24 Nyc Wholesale Meat Distributor With Great Cash Flow. Walk-ins and appointment information. You and Olive are my always girls.

In other states sales tax. To learn more see a full list of taxable and tax-exempt items in North Carolina. Connecticut In Connecticut food sold by eating establishments or caterers are subject to sales tax Effective October 1 2019 the Connecticut sales and use tax rate on meals sold by eating establishments caterers or grocery stores is 735.

Tangible personal property is defined in NC. Individual income tax. Tax on Restaurant Foods in North Carolina State Sales Tax.

Taxation of Food and Prepared Food NCDOR. 92 out of the 100 counties in North Carolina collect a local surtax of 2. The festival kicks off Friday April 22 from 6-9 p.

This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax. The North Carolina Pickle Festival returns to a live in-person event for 2022. The tax amount is a mathematical computation of the sales price of the Food multiplied by the 2 rate rounded to the nearest whole cent.

The Food and Beverage tax rate for Dare County is 1 of the sales price of prepared foods and beverages sold within the county for consumption on or off a premises by a retailer who is subject to sales tax under GS. The Wake County Board of Commissioners levied a Prepared Food and Beverage Tax of 1 of the sale price of prepared food and beverages effective January 1 1993. 50 minutes agoWe connect ambitious employers with the Pickle lovers get ready.

Appointments are recommended and walk-ins are first come first serve. With local taxes the total sales tax rate is between 6750 and 7500. Appointments are recommended and walk-ins are first come first serve.

Shop Overstock Deals Markdowns and More. North Carolina Department of Revenue. Groceries are generally defined as unprepared food while pre-prepared food may be subject to the restaurant food tax rate.

Sales and Use Tax NCDOR. 25 minutes agoJun 29 2015 Woodburn Premium Outlets. Closing on or before Sept.

GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. This tax is in addition to State and local sales tax. 105-1643 as personal property that may be seen weighed measured felt or touched or is.

This is the Connecticut state sales tax rate plus and additional 1 sales tax. This page describes the taxability of food and meals in North Carolina including catering and grocery food. You could also let the children paint a face on with foodcoloring.

On I-95 head towards West Palm Beach.

Washington Sales Tax For Restaurants Sales Tax Helper

2 Two Meat Plates For 22 Every Day In January Dickey S Barbecue Pit Rowlett Texas 5701 President George Bush Highway Kids Eat Free Barbecue Pit Kids Meals

Is Food Taxable In North Carolina Taxjar

2021 Tale Of The Whale Menu Page 10 Pomegranate Vodka Lemon Drop Martini Chocolate Martini

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Home Depot Sales Tax On Tool Rental Home Depot Sales Home Tools Rental

Are You Required To Pay Sales Tax On Restaurant Food Purchased For Resale

Everything You Need To Know About Restaurant Taxes

Taxes On Food And Groceries Community Tax

Is Food Taxable In North Carolina Taxjar

Thanksgiving Brunch At Blue Restaurant Bar Uptown Charlotte Nc Fresh Cranberry Sauce Brunch Restaurants Thanksgiving Brunch

South Carolina Sales Tax Rate 2022

64 Dollar Grocery Budget Harris Teeter Grocery Budgeting Harris Teeter Budget Food Shopping

Is Food Taxable In North Carolina Taxjar

Are You Required To Pay Sales Tax On Restaurant Food Purchased For Resale

Pinned June 26th 20 Off The Tab At Village Inn Restaurants Coupon Via The Coupons App Village Inn Village Inn

Review Flame Tree Barbecue At Disney S Animal Kingdom The Disney Food Blog Disney Food Blog Food Animal Kingdom Disney

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation