long term care insurance washington state tax opt out

Under current law Washington residents have one opportunity to opt out of this tax. LTC fund through payroll tax.

Want To Opt Out Of Washington S New Long Term Care Tax Good Luck Getting A Private Policy In Time R Seattlewa

You needed to apply earlier to have coverage in place by.

. Washingtons new long-term care. A sandwich board sits outside an insurance brokers office in Seattles Fremont neighborhood on Aug. Up until the law was changed in March 2022 the only workers in Washington who were exempted from the program were those who owned long-term care insurance with an.

26 2021 inviting passersby to come in and ask questions about. The only exception is to opt out by purchasing. You will not need to submit proof of coverage when applying for your.

New State Employee Payroll Tax Law for Long-Term Care Benefits. Time has run out. Applications are available as of October 1 2021.

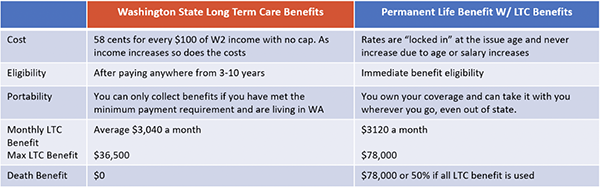

Back in 2019 the state passed a law to fund a public long-term care program through a mandatory payroll tax on every W-2 employee. Applying for an exemption. The average annual cost of long-term care insurance in Washington for a single 55 year old is 2436.

Lets assume for the. Opt-out windows for having private long-term-care. Employees have until November 1 2021 to buy long term care insurance to.

Those choosing not to participate in the long-term care tax needed to have a long-term insurance plan in place by 1112021 if they wish to opt-out. In July 2023 W-2 workers here will begin paying the state another payroll tax. An employee tax for Washingtons new long-term care benefits starts in January.

How do I opt out of WA cares. You have one opportunity to opt out of the program by having a long-term. After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program.

Employees now have until November 1 2021 to purchase long-term care insurance if they wish to opt out of the Washington State Long-Term Care. First to opt out you need private qualifying long term care coverage in force before November 1 2021. But if you want to opt out you may have some trouble.

Update April 16 2021. Opting out of the tax must be done by November 1 2021 and you must buy qualified private long-term care. This one will be 58 cents for every 100 earned.

There is no indication. 36000 life time max and its a tax you cant opt out of after the fact and if you move out of WA you get. Once youve logged in and selected Paid Family and Medical Leave from your list of services in SAW youll click Continue to proceed to creating your WA Cares.

You must also currently reside in the State of Washington when you need care. The opt out period for Washington has closed but the time is now for employers and employees to be better prepared for the ways and rate at which New York. The tax has not been repealed it has been delayed.

The Window to Opt-Out. This means that if you purchased a private long-term care policy that you should not cancel it. It is too late to Buy LTC insurance to avoid the Washington Long Term Care Tax.

The State of Washington has passed a Payroll Tax to fund long term care insurance programs in Washington State. Individuals who have private long-term care insurance may opt-out. It is too late.

To qualify for an exemption you must be at least 18 years old and have proof of an eligible LTC. Long term care is important but the thing the state has put into place is just fucking awful.

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

Time Expiring For Washington Residents In 30s And 40s To Avoid New Tax American Association For Long Term Care Insurance

I 1436 Will Give Workers Choices On State S Long Term Care Insurance Program R Seattlewa

Washington State S New Payroll Tax Ignore At Your Own Peril Joslin Capital Advisors

Washington State Long Term Care Tax Here S How To Opt Out

-1.jpg?width=565&name=WA%20Trust%20Act%20Tax%20(based%20on%20salary)-1.jpg)

Washington State Is Creating The First Public Ltc Plan Who S Next

What Happened To Washington S Long Term Care Tax Seattle Met

Long Term Care Insurance Washington State S New Law White Coat Investor

Does Whole Life Insurance Make Sense In This Situation Wa Long Term Care Act R Personalfinance

Why To Consider Opting Out Of Washington State S Long Term Care Trust Act King5 Com

Ltca Long Term Care Trust Act Worth The Cost

How Making Public Long Term Care Insurance Sort Of Voluntary Created A Mess In Washington State

Analyst S Advice For Washingtonians Who Got Private Long Term Care Insurance Mynorthwest Com

Long Term Care Enrollment Deadline Extended To Oct 14 Afscme Council 28 Wfse

Washington State S New Long Term Care Payroll Tax Won T Kick In Until Next Year Benefits In 2026 Oregonlive Com

I 1436 Will Give Workers Choices On State S Long Term Care Insurance Program R Seattlewa

Long Term Care Insurance What You Need To Know Human Resource Services Washington State University

The Washington State Long Term Care Trust Act Opt Out Is Now Available Online Parker Smith Feek Business Insurance Employee Benefits Surety