car lease tax deduction canada calculator

Car lease tax deduction calculator. You can use a leasing calculator to estimate how much it will cost you to borrow money to buy a vehicle.

Top 10 Tax Deductions And Expenses For Small Businesses To Claim Wave Year End

85 List Price Or 35294 Sales Tax Whichever Is More As With A Purchased Vehicle Lease Payments Are Also Capped To The.

. In this case the formula will look like. Enter the total lease payments deducted for the vehicle before the tax year 2 3. Typically this is around 55 of the sale price of the car.

Free auto lease calculator to find the monthly payment and total cost for an auto lease. You can claim a maximum of 5000 business kilometres per car. Enter the total number of days the vehicle was leased in 2021 and previous years.

Say your business use is 60 percent and you are making a monthly payment of 400 on it. If you decide to take out a. Danielle calculates the expenses she can deduct for her van for the tax year as follows.

27000 business kilometres 30000 total kilometres x 7000 6300 If Murray has business or. It will confirm the deductions you include on your. Murray calculates the expenses he can deduct for his truck for the tax year as follows.

Lease payments made for 2021. Enter the total number of days the vehicle was leased in 2021 and previous years. Use this auto lease calculator to estimate what your car lease will.

28000 HST 35294 x 15 5294 HST 800 x 15 120. 334 Manufacturers list price. Car lease payments are considered a qualifying vehicle tax deduction according to the IRS.

Divide the interest rate by the number of payments and multiply the result by the figure you got in step. Actual amount incurred by the employer. If there is no.

66 cents per kilometre for the 201718 201617 and 201516. Are car lease payments tax deductible. If You Use A Passenger Vehicle To Earn Employment Income There Is A Limit On The Amount Of The Leasing Costs You Can Deduct.

Car Lease Tax Deduction Calculator. While the interest rate is a factor the down payment you are able to. Enter the total number of days the.

The ceiling for CCA for passenger vehicles will be increased from 30000 to 34000 before tax in respect of vehicles new and used acquired on or after January 1 2022. 5500 Number of days the car was leased in 2021. Another common reason is a lifestyle change.

You can write off 240 for every single lease payment the same formula applies to the other car. Enter the total lease payments deducted for the vehicle before 2021. The deductible business part.

With that being said there. 27000 business kilometres 30000 total kilometres 5400 4860. Now add GST and PST to 800 and multiply that amount by the total number of days you leased your vehicle during the year and divide the total by 30.

Enter the total lease payments deducted for the vehicle before 2021. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. The Automobile Benefits Online Calculator allows you to calculate the estimated automobile benefit for employees including shareholders based on the information you.

If you decide to take out a. Enter the total lease charges payable for the vehicle in the tax year 1 2. Enter the cars MSRP final negotiated price down payment sales tax length of the lease new car lending rate.

Should I Be Leasing A Car Financial Pipeline

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

How To Figure Out Your Monthly Car Lease Payment Yourmechanic Advice

Is Car Insurance Tax Deductible H R Block

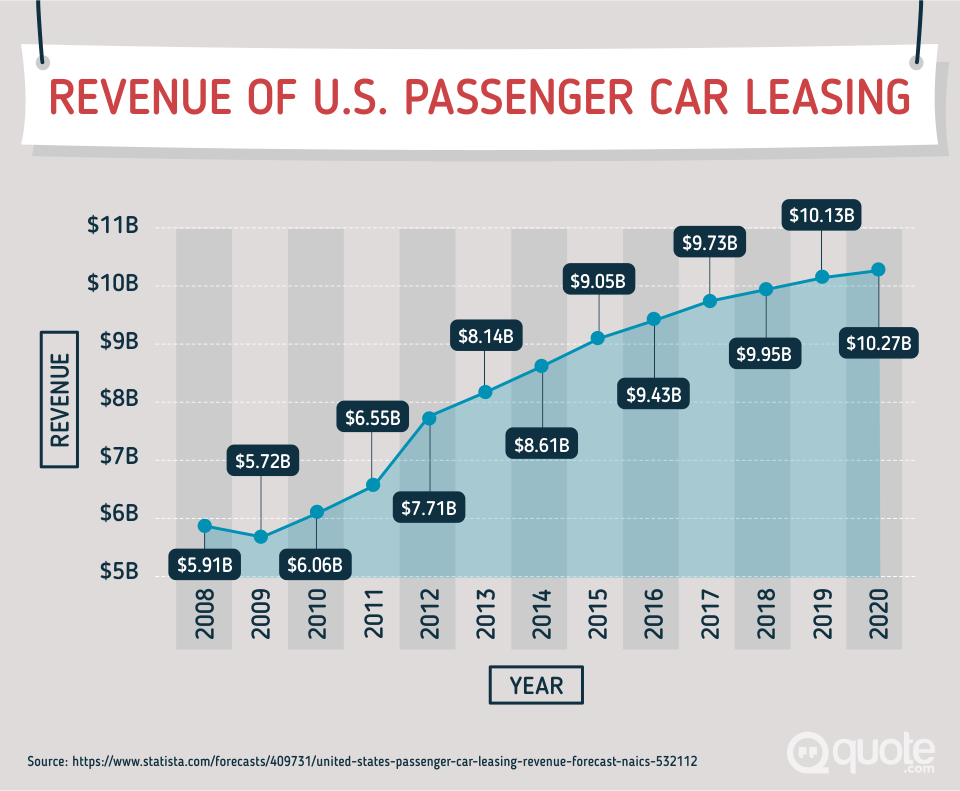

How To Lease A Car When You Can T Afford To Buy One Buy Vs Lease Calculator Quote Com

Leasing Versus Buying A Car Moneyzine Com

Kalfa Law How To Calculate Tax Deductions For Vehicle Expenses

Car Leasing Return Lease Return Vs Selling A Lease Car Edmunds

How To Figure Out Your Monthly Car Lease Payment Yourmechanic Advice

How To Write Off Vehicle Expenses Quickbooks Canada

Minnesota Vehicle Tax Deduction

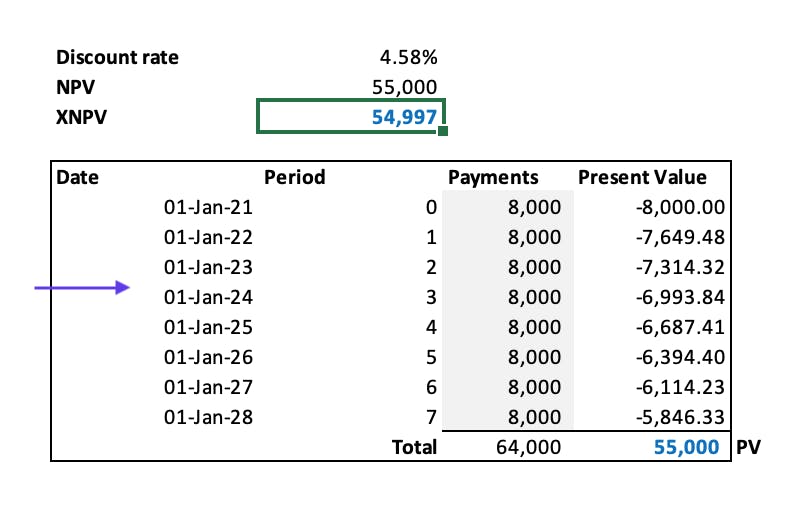

How To Calculate The Discount Rate Implicit In The Lease

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying-v1-735d3e7993d0435c8e1dcc0831af07bc.png)

Pros And Cons Of Leasing Or Buying A Car

Auto Lease Vs Buy Calculator Should You Buy Or Lease A Car

Most Overlooked Tax Deductions And Credits For The Self Employed Kiplinger

What Motor Vehicle Expenses Can Your Small Business Claim

The Fees And Taxes Involved In Car Leasing Complete Guide

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos